What is PMA? PMA stands for Penanaman Modal Asing or foreign investment. This is an exciting choice for foreigners who wish to do business in Indonesia.

Foreign investment or PMA is an investment activity in the territory of Indonesia carried out by foreign investors.

The investment or the capital will be used to build a company in Indonesia. It can come from one person or a joint venture with domestic shareholder.

To establish a PMA, one of the things that needs to be considered is what business fields are open or closed for this type of company.

The establishment of a PT PMA is regulated by Company Law. According to Presidential Regulation Number 44 Year 2016, commonly referred to as the Negative Investment List (DNI), some business fields are open to PMA.

DNI, or, in English, the Negative Investment List, serves to find out what business fields are open for investment, both domestic and foreign.

Based on DNI, there are three (three) business fields in investment activities: open business fields, open business fields with requirements, and closed business fields. An example of an open business field is a restaurant. In an open business field, 100% foreign ownership is possible.

Some examples of the fields are:

- 100% open to PMA: restaurants, bars, cafes, movie industry;

- Partially open to PMA: crop and food cultivation, oil and gas chartering services at sea, car maintenance and repair, and security consulting services.

Benefits of Set Up a PT PMA Establishment in Indonesia

So many benefits to establish a PT PMA Company in Indonesia, here are some:

Great Natural Resources

Indonesia’s strategic geographical location makes it a country rich in natural resources. It is recognized that the natural resources owned by Indonesia can make this country a superpower country.

There are various sectors ranging from mining, agriculture, forestry, marine, fisheries, livestock, and plantations. The tourism sector also attracts foreign investors because of Indonesia’s enchanting nature.

Large Domestic Market

Indonesia offers domestic market has great potential, judging from the business activities of both the Small and Medium Industries and the Manufacturing Industry, which continues to advance. The products from this small industry are of good quality. It can open to foreign investment as well.

Cheap and Creative Labor

One of the advantages of investing in Indonesia is the availability of a large workforce and relatively low labor costs. When compared to the costs incurred for foreign labor, it tends to be higher.

Investors can conduct skill preparation programs to meet the desired qualifications. Similarly, the workforce is encouraged to innovate and be creative in following technological advances.

Economic Condition

Indonesia’s economic condition continues to improve despite challenging global economic conditions. The Indonesian economy is resilient and is still considered capable of providing positive returns to investors, which can help attract investor to conduct business operations.

How to Establish a PT PMA in Indonesia and Tips to Own A Foreign-owned Company

Setting Up Capital. The first stage in the PMA establishment process is to prepare business capital. The capital requirements in the establishment of PMA is more than IDR 10 billion.

Having a total investment value of more than IDR 10 billion, which does not include land and buildings per business field, and having an issued or paid-up capital of at least IDR 10 billion unless otherwise determined by laws and regulations.

Completing Documents. In the process of establishing a PMA, the things that need to be made are the deed of establishment, the authorization letter from the Ministry of Law and Human Rights and the Company’s NPWP.

Investor Kitas. As the shareholders of PT PMA are partly or wholly foreigners, it is necessary to visit and even temporarily settle in Indonesia. Apart from having a residence permit, having an investor kitas gives foreign business partners or shareholders the right to work.

Determine the location. The business location must be determined in accordance with the regional spatial plan. The establishment of PMA, according to the latest regulation, must pay attention to whether the location is in accordance with the regional spatial plan.

In the case of PMA located in the Special Economic Zone, the provisions of business fields that are open with conditions do not apply except for business fields for MSMEs and cooperatives and business fields closed in investment.

Type of PMA

PMA company in Indonesia has several models. For reference, here are four classification that you can apply.

PMA Without Capital Market

Shares are usually circulated and purchased through the capital market. However, in this model, shares are purchased directly from national companies.

This can be done through the Investment Coordinating Board (BKPM) or other departments related to buying and selling foreign shares.

PMA Through Capital Market

The capital market is a meeting place for parties who need long-term investment instruments, such as securities. One form of securities is the shares of a PT PMA.

PT PMA shares are circulated through the national company stock exchange. Then, foreign parties who want to buy these shares must go through the capital market. That is a form of indirect foreign investment.

PMA through Lending

Have you ever gotten a loan from a bank? The procedure through lending is more or less the same as bank loans. The difference is that the lender is a foreign party. The forms vary, such as offshore loans, notes, bonds, and commercial activities paper.

Contractual PMA

It directly involves foreign investors and national companies. Both are bound by a written contract or agreement. Investment can take the form of technical assistance, agencies, or licenses.

Difference between PT and PMA

Perhaps you already know what a PMA and PT are, which are some of the most common forms of companies in Indonesia. What is the difference between PT and PMA? PT (Perseroan Terbatas) is a fairly popular business entity in Indonesia.

A significant difference is the capital. PT relies on domestic capital, while foreign parties invest in PT PMA.

Minimum Capital Difference

The amount of minimum capital requirement is the difference between these two business entities. The net worth of PT PMA investors must be more than IDR 10 billion, but this does not include the land and building of the business premises.

A medium-sized PT has a capital of more than IDR 500 million, while a large PT has a paid-up capital of more than IDR 10 billion.

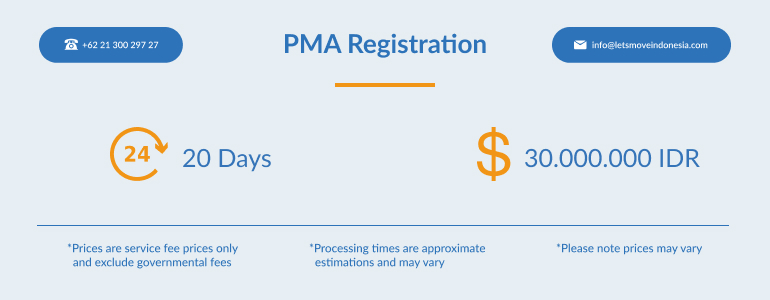

Special Package for PT PMA Registration with Lets Move Indonesia

It’s easier to take care of PMA registration in Indonesia with Lets Move Indonesia. With our expertise and knowledge of Indonesian company law and foreign direct investment regulations, we provide a seamless and efficient process for setting up a business entity.

With years of experience, that makes your business process smoother and easier. Contact Lets Move Indonesia’s team in Jakarta or Bali to assist with your company registration process.