KPR and KPA when Buying House in Indonesia

Many people need clarification about whether to get a house or an apartment. When it comes to buying property, there are many ways and methods provided, one of which is quite popular is KPR or Kredit Pemilikan Rumah.

You may have heard of KPR, but what about KPA? Do you know what the differences are between KPR and KPA?

Definition of KPR

KPR, or Kredit Pemilikan Rumah (Home Property Ownership Loan), is a credit facility from banks intended for individual customers to buy and repair houses. Currently, KPR is divided into two types: subsidised KPR, which can be applied for by the general public, and non-subsidized KPR for low-income people. To find out the details of the application, you can check the KPR simulation of BCA or other banks to get an idea of the costs you will incur from the time of submission to repayment later.

Definition of KPA

Meanwhile, KPA or Kredit Pemilikan Apartemen (Apartment Ownership Credit) is a bank or financial institution credit facility intended for individual customers to purchase apartment units. So, it can be concluded that the main difference between KPR and KPA is in the object, where KPR is for landed houses while KPA is for apartments.

Differences in Application Process and Requirements

When it comes to the process and application requirements between KPR and KPA, there is generally little housing market difference. For example, Bank Central Asia (BCA) has a KPR facility that is used for the purchase of houses, apartments, or shop houses either in new or second condition.

The process and submission requirements can be said to be the same. Both have document requirements that need to be completed. Here are the general requirements and document requirements for applying for KPR and KPA at one of the private banks in Indonesia.

Here are the document requirements that need to be prepared if you are an employee:

- Photocopy of Applicant ID Card

- Copy of husband’s/ wife’s ID card

- Copy of Marriage Certificate/Divorce Certificate/Death Certificate of Spouse

- Copy of Notarial Asset Separation Deed and registered to KUA or civil registry (if any)

- Copy of Family Card

- Copy of Applicant’s NPWP

- Copy of salary slip/certificate of income for the last one month

- Copy of Current Account / Savings Account for at least the last three months

- Developer’s House Reservation Letter / Property Agent Office Cover Letter

- Proof of appraisal payment

- Property Documents

- Copy of HM/HGB/HMSRS Certificate

- Copy of IMB

- Copy of the latest PBB when signing the PK

- Copy of Sale and Purchase Deed (AJB)

To get your KPR or KPA application approved, make sure that you have a good credit score, have never been blacklisted by Bank Indonesia, submit all the required documents, and make sure to be cooperative with the bank.

Most importantly, you must also prepare a down payment budget with the amount according to the bank’s policies or can be seen through the KPR or KPA instalment simulation.

Can foreigners use KPR and KPA for Property in Indonesia?

In the Regulation of the Minister of ATR / Head of BPN No. 29 of 2016 concerning Procedures for Granting, Releasing, or Transferring Rights to Ownership of Residential Houses or Occupancy by Foreigners Residing in Indonesia, it is stated that Hak Pakai occurs if a foreigner buys a property that already has the status of property rights or HGB, when purchased, the ownership status becomes State Land and then given a change to the Right of Use.

On the other hand, Bank Indonesia emphasized that there is no prohibition against banks accepting properties with Hak Pakai status as collateral. BI supports banks in starting to accept Hak Pakai as collateral.

In fact, BI also allows banks to provide KPR/KPA to foreigners with the same loan-to-value provisions as Indonesian citizens.

Banks that accept KPR and KPA for foreigners

Here are some banks that provide KPR services for foreigners:

1. Permata Syariah Bank

Eligibility:

- Foreigners who work and reside in Indonesia for at least two years (employee) or four years (entrepreneur).

- Net salary of at least IDR 25 million per month

- Property price of at least IDR2 billion

- Ceiling of at least Rp1 billion

- SHGB certificate

- Ready stock property

Benefit:

- This KPR service from Permata Bank is based on Sharia KPR.

2. Commonwealth Bank

- Ceiling: Up to IDR15 billion

- Tenor: 3-10 years

Eligibility:

- Age 21-60 years old at the end of the loan

- Domicile in Commonwealth Bank city

- Minimum two years of working experience

- SHGB certificate

3. J Trust Bank

Benefit:

- Competitive interest rate

- Tenor up to 30 years

Eligibility:

- Indonesian citizen or foreigner domiciled in Indonesia

- Minimum age of 21 years

- Minimum work period of 2 years

- Minimum three years of experience in the same field (professional/self-employed)

Mortgage Application Requirements for Foreigners

After knowing what banks provide mortgage facilities for foreigners, it is important to know the terms and conditions for applying for a mortgage for foreign nationals in Indonesia.

1. Must have an active KITAS

KITAS shows the legal status of foreigners in Indonesia and is one of the main requirements in the mortgage application process.

2. Profession and Employment Status

Many banks require foreigners to have an employment status when they want to use mortgage services in Indonesia. For example, Commonwealth Bank only accepts private employees with a minimum work duration of 2 years. Meanwhile, Permata Bank opens opportunities for foreigners who are entrepreneurs with a minimum of 4 years of experience in their field of business.

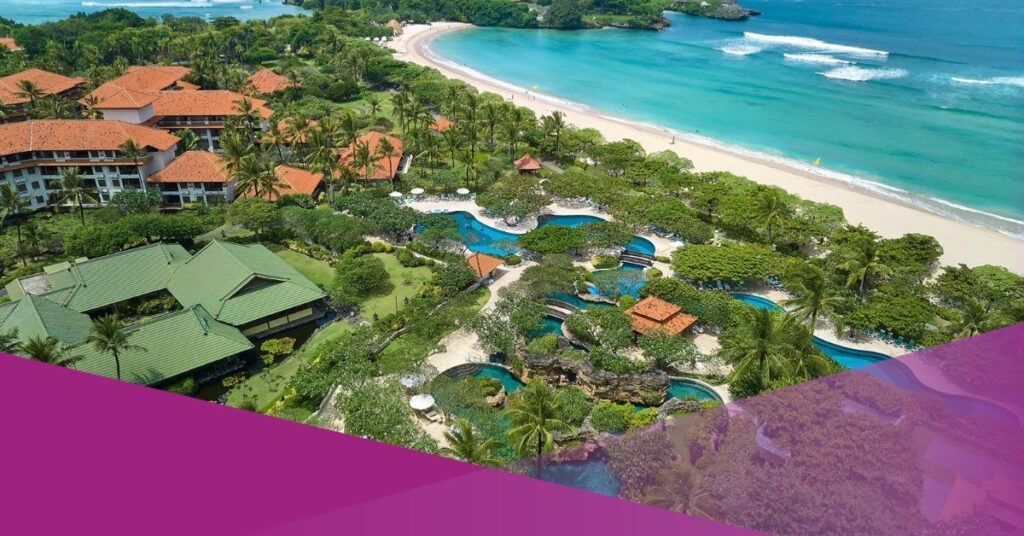

Buy Property with Lets Move Indonesia

Are you looking to invest in Indonesian real estate? Look no further! Social Expat is proud to promote Lets Move Indonesia. Whether you’re eyeing a beachfront villa in Bali or a bustling apartment in Jakarta, their services will help with the buying process, ensuring transparency and efficiency every step of the way.