From 1 January 2024, the Indonesian government will mandate every taxpayer to integrate a Single Identity Number (SIN) by synchronizing the taxpayer identification number (NPWP) with the identity number (NIK). This integration will facilitate tax reporting and validating payments in 2024.

The deadline for aligning NIK and NPWP is 31 December 2023. As per the Directorate General of Taxes (DJP) regulations, accessing this single identity number will streamline access to information concerning business activities, financial reports, transactions, and income tax.

Failure to match the NIK and NPWP within the specified timeframe will result in taxpayers encountering difficulties when conducting tax reporting tasks like annual notification letters and activating the Electronic Filing Identification Number (EFIN).

How To Sync Your ID and Tax for a Single Identity Number

You can easily match your NIK and NPWP online through the Indonesian tax ministry website. If you haven’t aligned your identity number and NPWP yet, here are a few steps you can take:

- Go to www.pajak.go.id, then select the login option.

- Input your 15-digit NPWP number, password, and the provided security code, then proceed with the login.

- After successful login, access the Profile menu located at the top. Enter your NIK as per your KTP details, choose “Check NIK validity,” and click on “Change Profile.”

- Subsequently, re-login using the 16-digit NIK, inputting the same password and security code (captcha) provided.

- If the profile menu displays a green “Valid” status alongside the NIK number, it indicates successful synchronization with the NPWP.

Is a Single Identity Number Required for Expats in Indonesia?

Foreign citizens residing in Indonesia are not required to update this information from their KITAS or passport. This requirement is mandatory only for Indonesian citizens possessing NPWP and e-KTP. Nevertheless, expatriates in Indonesia must adhere to several other policies, particularly concerning residence permits, visas, and taxes.

Let’s Move Indonesia offers comprehensive assistance for various necessities during your stay in Indonesia, ranging from visas and taxes to property. Below is a detail of each service provided by Let’s Move Indonesia:

Visa Service

- Single Entry Tourist Visa

- Working KITAS

- Investor KITAS (2 Years)

- Spouse Visa/KITAS

- Dependent Visa

- Retirement Visa

- Investor Visa

- Second-home Visa

- Repatriation Visa

- Family-Sponsored Visa

- Research Visa

- And many more!

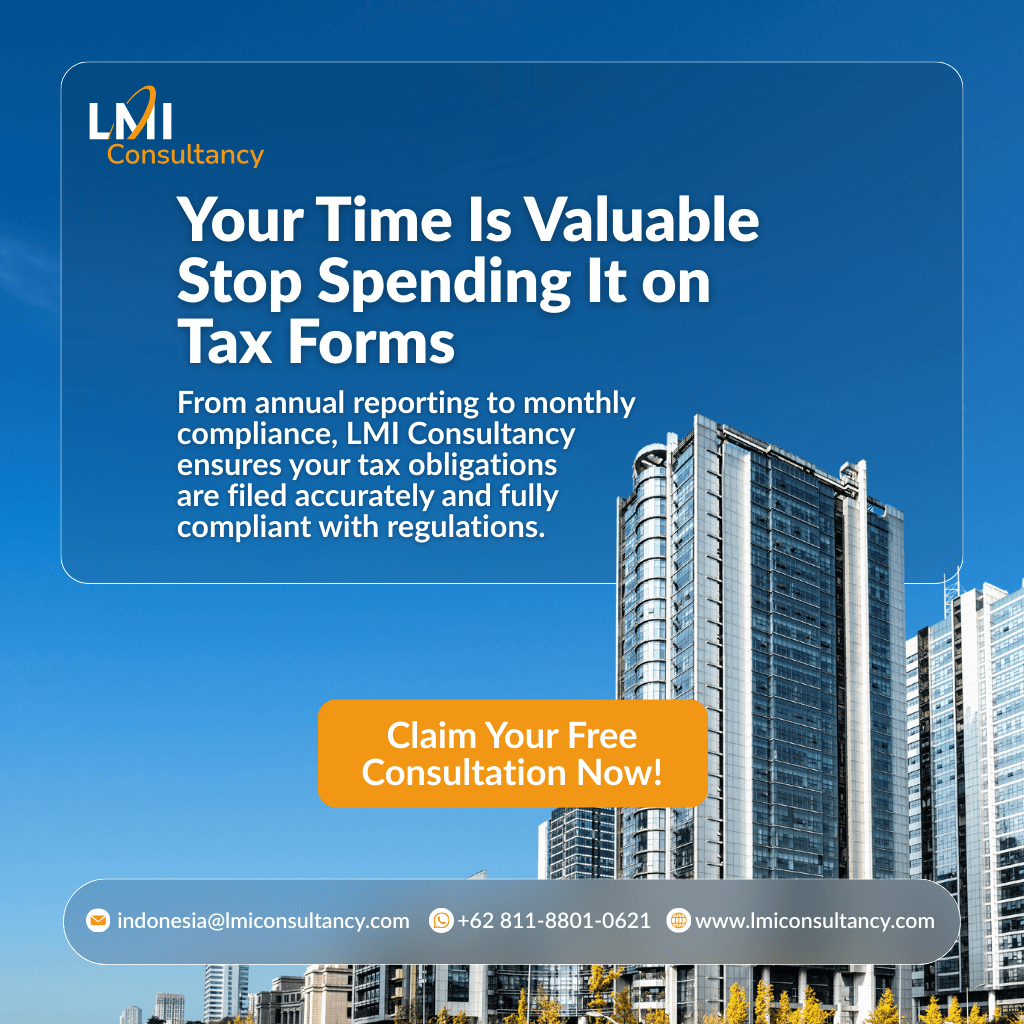

Tax & Accountancy

- Monthly Tax Reporting

- Annual Tax Reporting

- Individual Tax Reporting

- VAT Registration & Reporting

- BPJS Registration

- Payroll Management

- And many more!

Property Service

- Real Estate (Jakarta & Bali)

- Office & Commercial Space

- New Development

- Land for Sale

- Property Legal Service

- Property Finance Services

- Certificate Extension & Renewal

Doing business and residing in Indonesia becomes more accessible with Let’s Move Indonesia. Discover your business and personal needs through LetsMoveIndonesia! Explore further about LMI by clicking here.